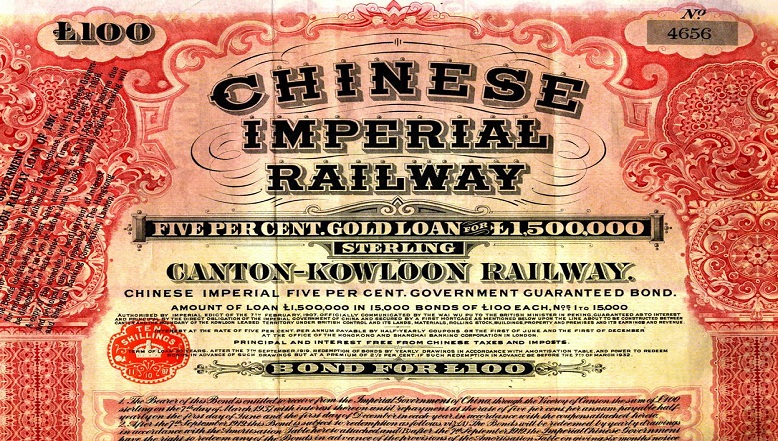

The Hongkong and Shanghai Banking Corporation Limited opened in Hong Kong on 3 March 1865 and in Shanghai one month later. It was the first locally owned bank to operate according to Scottish banking principles.

HSBC in Bahrain

Our services

HSBC Bahrain is one of the largest multinational banks in Bahrain, providing a comprehensive range of banking and financial services, supporting the growth ambitions of its customers from governments and multinationals to international corporates, family conglomerates, and individuals.

HSBC Bahrain offers a full range of financial services for personal, corporate, and institutional banking customers.

Our Global Payments Services Solutions (GPS) and Global Trade Services Solutions (GTS) propositions have received international recognition as best in class and offer simpler, better and faster banking services on digital banking platforms such as HSBCnet. We have a full team of experts that offer Institutional Fund Administration and Securities Custody and Clearing Services specifically targeted at the institutional business community.

HSBC’s Wealth and Premier Banking Solutions for retail customers offer seamless cross-border banking.

Our headquarters

Bldg 2505, Rd 2832

Plot 5780, Block 428

Seef District

Our CEO

Joseph Ghorayeb

History of HSBC in the Middle East

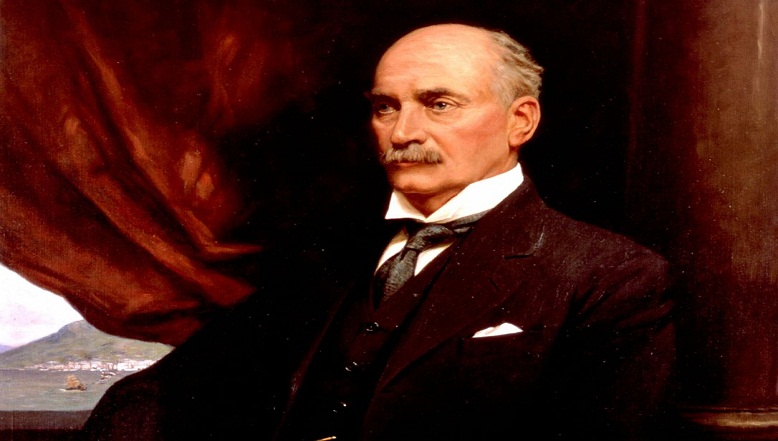

Origins

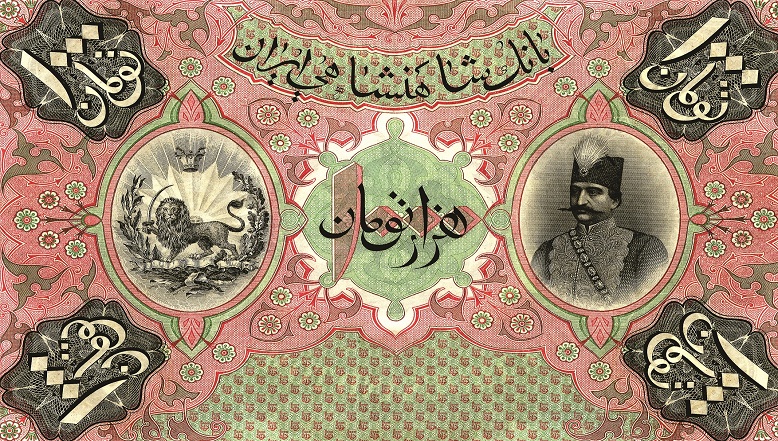

HSBC’s presence in the Middle East dates back to 1889 when the bank was known as The Imperial Bank of Persia. The bank changed its name to The Imperial Bank of Iran in 1935; The British Bank of Iran and the Middle East in 1949 and subsequently The British Bank of the Middle East in 1952 when operations in Iran were wound up. The Hongkong and Shanghai Banking Corporation Limited acquired The British Bank of the Middle East in 1959.

Diversification

The 1940s was a period of great change with the decline of operations in Iran (which closed in 1952) and expansion into the Arabian Peninsula and the Levant.

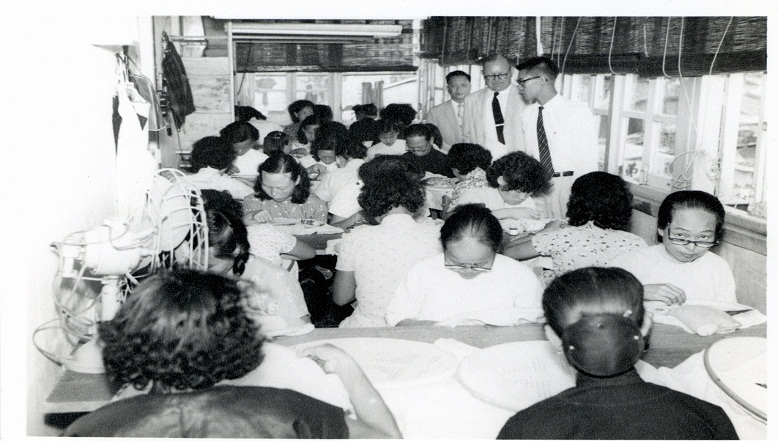

The bank was a leader in financial services in the states that are now referred to as the Gulf Cooperation Council, opening branches in Kuwait (1942), Bahrain (1944), the area now known as the UAE (1946), Oman (Muscat 1948) and Saudi Arabia (Al Khobar and Jeddah 1950).

Branches were also opened in the cities of the Fertile Crescent: Beirut (1946), Damascus (1947), Tripoli (1948), Amman (1949) and Aleppo (1951).

Regional expansion

By 1959, when the bank was acquired by the Group, it had added more offices in Saudi Arabia, Yemen, Libya, Qatar, Tunisia, Morocco and UAE.

During the 1960s and 1970s the bank left Syria, Iraq, South Yemen and Libya after nationalisation of the banking sectors.

In 1978, the bank’s business in Saudi Arabia was transferred to a new bank, the Saudi British Bank, where the Group took a 40 per cent share. The Group also took a 40 per cent share in the Hong Kong Egyptian Bank S.A.E, which was established in 1982.

Modern structure

In 1994, the bank's head office was transferred to Jersey and in 1999 it was renamed HSBC Bank Middle East (HBME). In 2001, the Group’s shareholding in Egypt increased to 94.5 per cent. In June 2016, the bank confirmed that it had transferred its place of incorporation and head office from Jersey to the Dubai International Financial Centre. As a result of the transfer, HBME is now lead-regulated by the Dubai Financial Services Authority, but remains locally regulated in each of the countries in which it operates by the country’s Central Bank and its other regulators.

HSBC Bahrain

Sustainability is unlocking business growth Opens in new window

The commercial case for sustainability has reached a critical mass, placing it firmly on the agenda of many businesses globally, says Natalie Blyth.

Carers need more tailored financial support Opens in new window

We have a responsibility to step in and address the financial challenges faced by carers – and to help them find the tailored financial support that they need, says Steve Reay.

Younger generations investing with greater confidence Opens in new window

Younger generations of savvy, digital natives are investing in their financial futures with more confidence and control than older generations, says Jenny Wang.